What is Illegal Recruitment?

Any act of canvassing, enlisting, contracting, transporting, utilizing, hiring or procuring workers and includes referring, contract services, promising or advertising for employment abroad, whether for profit or not, when undertaken by a non-license or non-holder of authority contemplated under Art 13 (F) of Presidential Decree No. 442, as amended otherwise known as the Labor Code of the Philippines: Provided, That any such non-licensee or non-holder who, in any manner, offers or promises for a fee employment abroad to two or more persons shall be deemed so engaged. (sec. 6, RA 8042).

It shall likewise include the following acts, whether committed by any persons, whether a non-licensee, non-holder, licensee or holder of authority.

(a) To charge or accept directly or indirectly any amount greater than the specified in the schedule of allowable fees prescribed by the Secretary of Labor and Employment, or to make a worker pay any amount greater than that actually received by him as a loan or advance;

(b) To furnish or publish any false notice or information or document in relation to recruitment or employment;

(c) To give any false notice, testimony, information or document or commit any act of misrepresentation for the purpose of securing a license or authority under the Labor Code;

(d) To induce or attempt to induce a worker already employed to quit his employment in order to offer him another unless the transfer is designed to liberate a worker from oppressive terms and conditions of employment;

(e) To influence or attempt to influence any persons or entity not to employ any worker who has not applied for employment through his agency;

(f) To engage in the recruitment of placement of workers in jobs harmful to public health or morality or to dignity of the Republic of the Philippines;

(g) To obstruct or attempt to obstruct inspection by the Secretary of Labor and Employment or by his duly authorized representative;

(h) To fail to submit reports on the status of employment, placement vacancies, remittances of foreign exchange earnings, separations from jobs, departures and such other matters or information as may be required by the Secretary of Labor and Employment;

(i) To substitute or alter to the prejudice of the worker, employment contracts approved and verified by the Department of Labor and Employment from the time of actual signing thereof by the parties up to and including the period of the expiration of the same without the approval of the Department of Labor and Employment;

(j) For an officer or agent of a recruitment or placement agency to become an officer or member of the Board of any corporation engaged in travel agency or to be engaged directly on indirectly in the management of a travel agency;

(k) To withhold or deny travel documents from applicant workers before departure for monetary or financial considerations other than those authorized under the Labor Code and its implementing rules and regulations;

(l) Failure to actually deploy without valid reasons as determined by the Department of Labor and Employment; and

(m) Failure to reimburse expenses incurred by the workers in connection with his documentation and processing for purposes of deployment, in cases where the deployment does not actually take place without the worker’s fault. Illegal recruitment when committed by a syndicate or in large scale shall be considered as offense involving economic sabotage.

Illegal recruitment is deemed committed by a syndicate carried out by a group of three (3) or more persons conspiring or confederating with one another. It is deemed committed in large scale if committed against three (3) or more persons individually or as a group.

The persons criminally liable for the above offenses are the principals, accomplices and accessories. In case of juridical persons, the officers having control, management or direction of their business shall be liable.

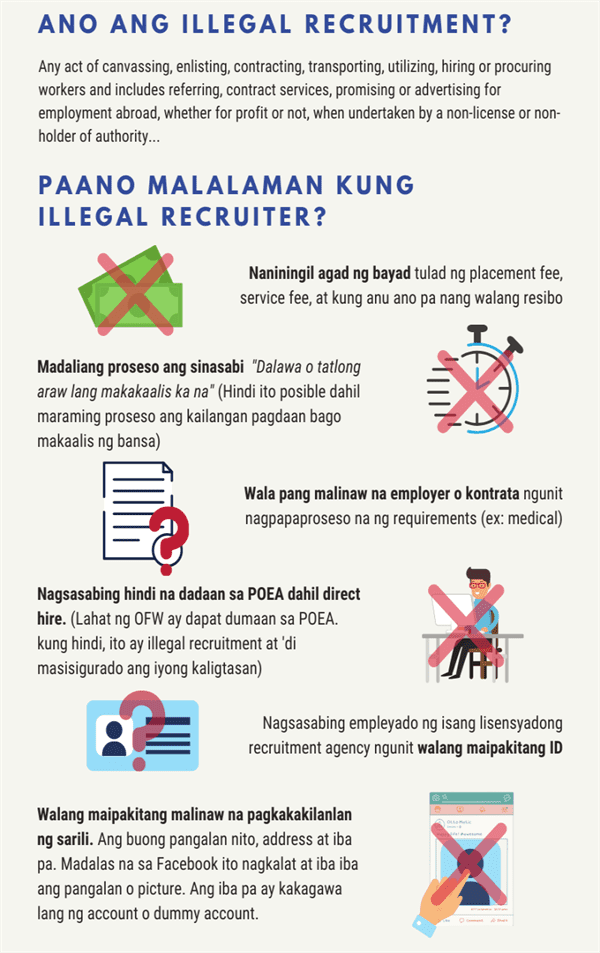

Identify an illegal recruiter

Identify an illegal recruiter

Ang illegal recruiter ay:

- Agad naniningil ng placement fee o anumang kaukulang bayad nang walang resibo

- Nangangako ng madaliang pag-alis patungo sa ibang bansa

- Nagre-require agad ng medical examination o training kahit wala pang malinaw na employer o kontrata

- Nakikipag-transaksiyon sa mga aplikante sa mga pampublikong lugar tulad ng restaurant, mall, atbpa. at hindi sa opisina ng lisensyadong ahensiya

- Bahay-bahay kung mag-recruit ng mga aplikante

- Hindi nagbibigay ng sapat na impormasyon tungkol sa ina-aplayang trabaho

- Nagsasabi na may kausap na direct employer at ang mga aplikante ay di na kailangang dumaan sa POEA

- Nangangako ng mabilis na pag-alis ng aplikante gamit ang tourist o visit visa

- Walang maipakitang employment contract o working visa

- Nagpapakilala na empleyado ng isang lisensyadong recruitment agency ngunit walang maipakitang ID

- Nagpapakilala na konektado sa isang travel agency o training center

- Nanghihikayat sa mga aplikante na mangalap ng iba pang aplikante upang mapabilis ang pagpapaalis

- Walang maibigay na sapat at tamang impormasyon tungkol sa sarili tulad ng buong pangalan o address

- Nangangako na ang mga dokumento ay ipapasok sa POEA para mai-process (lalo na sa kaso ng EPS-Korea)

How to Avoid Illegal Recruitment

- Do not apply at recruitment agencies not licensed by POEA.

- Do not deal with licensed agencies without job orders.

- Do not deal with any person who is not an authorized representative of a licensed agency.

- Do not transact business outside the registered address of the agency. If recruitment is conducted in the province, check if the agency has a provincial recruitment authority.

- Do not pay more than the allowed placement fee. It should be equivalent to one month salary, exclusive of documentation and processing costs.

- Do not pay any placement fee unless you have a valid employment contract and an official receipt.

- Do not be enticed by ads or brochures requiring you to reply to a Post Office (P.O.) Box, and to enclose payment for processing of papers.

- Do not deal with training centers and travel agencies, which promise overseas employment.

- Do not accept a tourist visa.

- Do not deal with fixers.

Modus Operandi of Illegal Recruiters

- Escort Services – Undocumented workers are escorted at the airport or any international exit to evade checkpoints set to check on the documents of workers.

- Tourist–Worker Scheme – Workers leave the country purportedly as tourist but in reality is being deployed as worker abroad.

- Assumed Identity – Workers particularly minors are deployed abroad under an assumed identity.

- Direct Hiring – Workers are hired by foreign employers without the intervention of licensed recruitment agencies and are deployed undocumented and without protection.

- Trainee Worker Scheme – Hired workers are deployed allegedly not for employment but for training purposes only and will return to sending company after training.

- Backdoor Points Scheme – Workers are sent abroad not through regular exit channels like airports but are deployed usually through cargo ships.

- Tie-Up System – Unlicensed recruiters with foreign principals who are usually in the blacklist use the name and offices of licensed recruiters in their illegal activity.

- Visa Assistance/Consultancy Scheme – Firms that offer services including the pairing of workers with foreign employers and promising applicants immigrant visas but are in reality engaged in the recruitment business.

- Blind Ads Scheme – Workers are enticed to apply and send cash payments addressed to a Postal Office Box without the worker having the opportunity to communicate personally with the recruiter.

Policy on Immigration Consultants

MC 10, series of 2003

Immigration consultancy agencies and similar entities which are based locally, are required to obtain a license in accordance with the guidelines as provided for in Part II, Rule I, secs. 1 and 2 and Rule 2, secs. 1 to 5 of the 2002 POEA Rules and Regulations, before they may engage in recruitment and placement activities, regardless of the visa under which deployment shall be made eventually.

FEES shall be duly covered with OFFICIAL RECEIPTS and may be collected only AFTER a worker has been issued the necessary EB3 Visa.

Tips to job applicants using the internet in job search:

- Read the entirety of the website. Examine whether the company name and profile appear believable. Check for its company profile or the “about us” page to see its office location and phone numbers.

- Examine the website design plus all links and pages available. A legitimate company would not mind spending a large money to have a website designed beautifully as the same serves as the business’s window to the world.

- Take note of the website’s invitations to send resumes and application papers through postal mail or drop boxes. Most legitimate websites would like you to fill up your resume online or send them through e-mail.

- Take note of their offers. Most of them offer “too-good-to-be-true” salaries and other job perks including free accommodation and bonuses.

- Use search engines (yahoo!, google, etc.) and look for the company’s name or topics similar to those discussed in the website you have visited.

- Check the domain name of the website to secure additional information.

- Report to the POEA or other law enforcement authorities any illegal recruitment activities conducted through the internet.

Top 10 Internet Scams

1) The Nigerian scam, also known as 419

Most of you have received an email from a member of a Nigerian family with wealth. It is a desperate cry for help in getting a very large sum of money out of the country. A common variation is a woman in Africa who claimed that her husband had died, and that she wanted to leave millions of dollars of his estate to a good business.

In every variation, the scammer is promising obscenely large payments for small unskilled tasks. This scam, like most scams, is too good to be true. Yet people still fall for this money transfer con game.

They will use your emotions and willingness to help against you. They will promise you a large cut of their business or family fortune.

All you are asked to do is cover the endless legal and other fees that must be paid to the people that can release the scammer’s money.

The more you are willing to pay, the more they will try to suck out of your wallet. You will never see any of the promised money, because there isn’t any. And the worst thing is, this scam is not even new; its variant dates back to 1920s when it was known as ‘The Spanish Prisoner’ con.

2) Advanced fees paid for a guaranteed loan or credit card

If you are thinking about applying for a “pre-approved” loan or a credit card that charges an up-front fee, ask yourself: “why would a bank do that?”. These scams are obvious to people who take time to scrutinize the offer.

Remember: reputable credit card companies do charge an annual fee but it is applied to the balance of the card, never at the sign-up. Furthermore, if you legitimately clear your credit balance each month, a legitimate bank will often wave the annual fee.

As for these incredible, pre-approved loans for a half-a-million dollar homes: use your common sense. These people do not know you or your credit situation, yet they are willing to offer massive credit limits.

Sadly, a percentage of all the recipients of their “amazing” offer will take the bait and pay the up-front fee.

If only one in every thousand people fall for this scam, the scammers still win several hundred dollars. Alas, far too many victims, pressured by financial problems, willingly step into this con man’s trap.

3) Lottery scams

Most of us dream of hitting it big, quitting our jobs and retiring while still young enough to enjoy the fine things in life. Chances are you will receive at least one intriguing email from someone saying that you did indeed win a huge amount of money. The visions of a dream home, fabulous vacation, or other expensive goodies you could now afford with ease, could make you forget that you have never ever entered this lottery in the first place.

This scam will usually come in the form of a conventional email message. It will inform you that you won millions of dollars and congratulate you repeatedly. The catch: before you can collect your “winnings”, you must pay the “processing” fee of several thousands of dollars.

Stop! The moment the bad guys cash your money order, you lose.

Once you realize you have been suckered into paying $3000 to a con man, they are long gone with your money. Do not fall for this lottery scam.

4) Phishing emails and phony web pages

This is the most widespread Internet and email scam today. It is a “sting” con game. “Phishing” is identity and password theft based on convincing emails and web pages. These emails and web pages resemble legitimate credit authorities like Citibank, eBay, or Paypal. They frighten or entice you into visiting a phony web page and entering your ID and password. Commonly, the guise is an urgent need to “confirm your identity”. They will even offer you a story of how your account has been attacked by hackers to lure you into entering your confidential information.

The email message will require you to click on a link. But instead of leading you to the real login https: site, they will to a fake website. The fake website is often very convincing looking.

You then innocently enter your ID and password. This information is intercepted by the scammers, who later access your account and fleece you for several hundred dollars.

This phishing con , like all cons, depends on people believing the legitimacy or their emails and web pages. Because it was born out of hacking techniques, “fishing” is stylistically spelled “phishing” by hackers.

Tip: the beginning of the link address should have https://. Phishing fakes will just have http:// (no”s” . If still in doubt, make a phone call to the financial institution to verify if the email is legit. In the meantime, never click on the link in any suspicious email.

5) Items for sale overpayment scam

This one involves an item you might have listed for sale such as a car, truck or some other expensive item. The scammer finds your ad and sends you an email offering to pay much more than your asking price. The reason for overpayment is supposedly related to the international fees to ship the car overseas. In return, you are to send him the car and the cash for the difference.

The money order you receive looks real so you deposit it into your account. In a couple of days (or the time it takes to clear) your bank informs you the money order was fake and demands you pay that amount back immediately.

In most documented versions of this money order scam, the money order was indeed an authentic document, but it was never authorized by the bank it was stolen from.

In the case of cashier’s checks, it is usually a convincing forgery. You have now lost the car, the cash you sent with the car, and you owe a hefty sum of money to your bank to cover for the bad money order or the fake cashier’s check.

6) Employment scams

You have posted your resume, with at least some personal data accessible by potential employers, on a legitimate employment site. You receive a job offer to become a “financial representative” of an overseas company you have never even heard of before. The reason they want to hire you is that this company has problems accepting money from US customers and they need you to handle those payments. You will be paid 5 to 15 percent commission per transaction.

If you apply, you will provide the scammer with your personal data, such as bank account information, so you can “get paid”. Instead, you will experience some, or all, of the following:

* identity theft, * money stolen from your account, or * may receive fake checks or money orders for payments which you deposit into your account but must send 85 – 95 percent of that to your “employer”.

Soon you will owe much money to your bank!

In other instance, you will receive an unsolicited e-mail message from a “multinational company” congratulating you for being selected for a specific job. The e-mail contains details about the “hiring company”, the positions needed, and a very enticing compensation package.

You will be asked to send money through Western Union as processing fee or reservation fee.

7) Disaster relief scams

What do 9-11, Tsunami and Katrina have in common? These are all disasters, tragic events where people die, lose their loved ones, or everything they have. In times like these, good people pull together to help the survivors in any way they can, including online donations. Scammers set up fake charity websites and steal the money donated to the victims of disasters.

If your request for donation came via email, there is a chance of it being a phishing attempt. Do not click on the link in the email and volunteer your bank account or credit card information.

Your best bet is to contact the recognized charitable organization directly by phone or their website.

8) Travel scams

These scams are most active during the summer months. You receive an email with the offer to get amazingly low fares to some exotic destination but you must book it today or the offer expires that evening. If you call, you’ll find out the travel is free but the hotel rates are highly overpriced.

Some can offer you rock-bottom prices but hide certain high fees until you ‘sign on the dotted line’. Others, in order to give you the ‘free’ something, will make you sit through a timeshare pitch at the destination. Still others can just take your money and deliver nothing.

Also, getting your refund, should you decide to cancel, is usually a lost cause, often called a nightmare or mission-impossible.

Your best strategy is to book your trip in person, through a reputable travel agency or proven legitimate online service like Travelocity or Expedia.

9) “Make Money Fast” chain emails

A classic pyramid scheme: you get an email with a list of names, you are asked to send 5 dollars (or so) by mail to the person whose name is at the top of the list, add your own name to the bottom, and forward the updated list to a number of other people.

The author of this scam letter painstakingly explains that, if more and more people join this chain, when it’s your turn to receive the money, you might even become a millionaire!

Bear in mind that, most times, the list of names is manipulated to keep the top name (the creator of the scam, or his friends) on top, permanently.

As with the previously circulating snail-mail version of this chain, the email edition is just as illegal. Should you choose to participate, you risk being charged with fraud – definitely not something you want on your record, or resume.

10) “Turn Your Computer Into a Money-Making Machine!”

Although not a full blown scam, this scheme works as follows: You send someone money for instructions on where to go and what to download and install on your computer to turn it into a money-making machine — for spammers.

At sign-up, you get a unique ID and you have to give them your PayPal account information for the “big money’ deposits you’ll soon be receiving. The program that you are supposed to run, sometimes 24/7, opens multiple ad windows, repeatedly, thus generating per-click revenue for spammers.

In other scenario, your ID is limited to a certain number of page clicks per day. In order to make any money whatsoever from this scheme, you are pretty much forced to scam the spammers by hiding your real IP address with Internet proxy services such as “findnot”, so you can make more page clicks.

I won’t even go into the discussion about what this program will do to your computer’s performance… it is a true tragedy if you get conned into this scam.